- Substitute W 9 Form Download For Pc

- Printable W-9 Form

- Irs Substitute W-9 Form

- Substitute W 9 Fillable

- Substitute W 9 Requirements

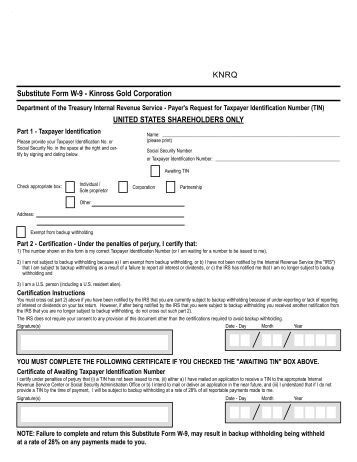

Exhibit 99.4

To complete Substitute Form W-9 if you do not have a taxpayer identification number, write “Applied For” in the space for the taxpayer identification number in Part I, sign and date the Form, and give it to the requester. Note: failure to complete and return this form may result in backup withholding of 28% of any gross payments made to you pursuant to the option. Please review the enclosed “guidelines for certification of taxpayer identification number on substitute form w-9” for additional details. Form W-9 (Rev. October 2018) Department of the Treasury. If you are a U.S. Person and a requester gives you a form other than Form W-9 to request your TIN, you must use the requester’s form if it is substantially similar to this Form W-9. Definition of a U.S. Form W-9 and it satisfies certain certification requirements. You may incorporate a substitute Form W-9 into other business forms you customarily use, such as account signature cards. However, the certifications on the substitute Form W-9 must clearly state (as shown on the official Form W-9) that under penalties of perjury: 1. The payee's TIN. Number, to apply for an EIN. You can get Forms W. The TIN, sign and date the form, and give it to the requester. For interest and dividend payments, and Commonwealth of Virginia Substitute W-9 Form Instructions. Reasonable basis that results in no backup withholding, you are subject to a $500 penalty. Criminal penalty for falsifying information. Fill out a W-9 in minutes using a step-by-step template. A W-9 is a tax document issued to independent contractors and freelancers. Nov 20, 2018 - Form W-9 (or an acceptable substitute) is used by persons required to file information returns with the IRS to get the payee's (or other person's).

The holder is required to give the Payer hisor her TIN (e.g., Social Security Number or Employer Identification Number). If the Outstanding Notes are held in more than one name or are held not in the name of the actual owner, consult the enclosed “Guidelines for Certification of TaxpayerIdentification Number on Substitute Form W-9” for additional guidance on which number to report.

| PAYER’S NAME: WELLS FARGO BANK, NATIONALASSOCIATION | ||||||

SUBSTITUTE FORM W-9 | Part 1 — PLEASEPROVIDE YOUR TIN IN THE BOX TO THE RIGHT AND CERTIFY BY SIGNING AND DATING BELOW. | Social Security Number Employer Identification Number | ||||

Department of the Treasury

| Part 2 — Certification— Under penalties of perjury, I certify that: (1) The number shown on this form is my correct Taxpayer Identification Number (or I amwaiting for a number to be issued to me), (3) I am a U.S.citizen or other U.S. person (including a U.S. resident alien). | Part 3 Awaiting TIN Part 4 Exempt from backup | ||||

| Certificate instructions — You must cross out item (2) in Part2 above if you have been notified by the IRS that you are subject to backup withholding because of under-reporting interest or dividends on your tax return. However, if after being notified by the IRS that you were subject to backup withholding youreceive another notification from the IRS stating that you are no longer subject to backup withholding, do not cross out item (2). | ||||||

| Signature | ||||||

| Name | ||||||

| Address: | ||||||

| (Please Print) | ||||||

| Date | , 2012 | |||||

YOU MUST COMPLETE THE FOLLOWING CERTIFICATE IF YOU CHECKED

THE BOX IN PART 3 OF SUBSTITUTE FORM W-9

CERTIFICATE OF AWAITING TAXPAYER IDENTIFICATION NUMBER

I certify under penalty of perjury that a taxpayer identification number has not been issued to me,and either (a) I have mailed or delivered an application to receive a taxpayer identification number to the appropriate Internal Revenue Service Center or Social Security Administration Office, or (b) I intend to mail or deliver anapplication in the near future. I understand that if I do not provide a taxpayer identification number by the time of payment, all reportable payments made to me thereafter will be subject to backup withholding at the applicable withholding rate(which is currently 28%) until I provide such a number.

Signature | ||

Name: | ||

(please print) | ||

Date | , 2012 | |

| NOTE: | FAILURE TO COMPLETE AND RETURN THIS FORM MAY RESULT IN BACKUP WITHHOLDING AT THE APPLICABLE WITHHOLDING RATE (WHICH IS CURRENTLY 28%) ON ANY REPORTABLE PAYMENTS MADETO YOU. PLEASE REVIEW THE ENCLOSED “GUIDELINES FOR CERTIFICATION OF TAXPAYER IDENTIFICATION NUMBER ON SUBSTITUTE FORM W-9” FOR ADDITIONAL DETAILS. |

GUIDELINES FOR CERTIFICATION OF TAXPAYER IDENTIFICATION

NUMBER ON SUBSTITUTE FORM W-9

| For this type of account: | Give name and SOCIAL SECURITY Number of — | ||

| 1. | An individual’s account | The individual | |

| 2. | Two or more individuals (joint account) | The actual owner of the account or, if combined funds, the first individual on the account(1) | |

| 3. | Custodian account of a minor (Uniform Gift to Minors Act) | The minor(2) | |

| 4. | a. A revocable savings trust account (in which grantor is also trustee) | The grantor trustee(1) | |

b. Any “trust” account that is not a legal or valid trust under State law | The actual owner(1) | ||

| 5. | Sole proprietorship account or disregarded entity owned by an individual | The owner(3) | |

| 6. | A valid trust, estate, or pension trust | The legal entity (Do not furnish the identifying number of the personal representative or trustee unless the legal entity itself is not designated in the accounttitle.)(4) | |

| For this type of account: | Give name and EMPLOYER IDENTIFICATION Number of— | ||

| 7. | Sole proprietorship account or disregarded entity not owned by an individual | The owner(3) | |

| 8. | Corporate account or entity electing corporate status | The corporation | |

| 9. | A valid trust, estate, or pension trust | The legal entity (Do not furnish the identifying number of the personal representative or trustee unless the legal entity itself is not designated in the accounttitle.)(4) | |

| 10. | Religious, charitable or educational organization account | The organization | |

| 11. | Partnership or multi-member LLC treated as a partnership | The partnership | |

| 12. | Association, club, or other tax-exempt organization | The organization | |

| 13. | A broker or registered nominee | The broker or nominee | |

| 14. | Account with the Department of Agriculture in the name of a public entity (such as a State or local government, school district, or prison) that receives agricultural programpayments | The public entity | |

| (1) | List first and circle the name of the person whose number you furnish. |

| (2) | Circle the minor’s name and furnish the minor’s social security number. |

| (3) | You must show your individual name, but you may also enter your business or “doing business as” name. You may use either your Employer Identification Numberor your Social Security Number. |

| (4) | List first and circle the name of the legal trust, estate, or pension trust. |

| Note: | If no name is circled when there is more than one name, the number will be considered to be that of the first name listed. |

GUIDELINES FOR CERTIFICATION OF TAXPAYER IDENTIFICATION

NUMBER OF SUBSTITUTE FORM W-9

Obtaining a Number

To complete Substitute Form W-9 if you do not have a taxpayeridentification number, write “Applied For” in the space for the taxpayer identification number in Part I, sign and date the Form, and give it to the requester. Generally, you will then have 60 days to obtain a taxpayer identificationnumber and furnish it to the requester. If the requester does not receive your taxpayer identification number within 60 days, backup withholding, if applicable, will begin and will continue until you furnish your taxpayer identification number tothe requester.

Payees Exempt from Backup Withholding

Payees specifically exempted from backup withholding include the following:

| 1. | An organization exempt from tax under Section 501(a), or an individual retirement plan or a custodial account under Section 403(b)(7), if the accountsatisfies the requirements of Section 401(F)(2). |

| 2. | The United States or any agency or instrumentality thereof. |

| 3. | A State, the District of Columbia, a possession of the United States, or any political subdivision or instrumentality thereof. |

| 4. | A foreign government or a political subdivision thereof, or any agency or instrumentality thereof. |

| 5. | An international organization or any agency or instrumentality thereof. |

| 6. | A corporation |

| 7. | A foreign central bank of issue. |

| 8. | A dealer in securities or commodities required to register in the United States, the District of Columbia, or a possession of the United States. |

| 9. | A futures commission merchant registered with the Commodity Futures Trading Commission. |

| 10. | A real estate investment trust. |

| 11. | An entity registered at all times during the tax year under the Investment Company Act of 1940. |

| 12. | A common trust fund operated by a bank under Section 584(a). |

| 13. | A financial institution. |

| 14. | A middeman known in the investment community as a nominee or custodian. |

| 15. | A trust exempt from tax under section 664 or described in section 4947. |

Backup withholding is not required on any interest payments to any exempt payees described above except forpayees described in line 9.

Exempt payees described above should file a Substitute Form W-9 to avoid possible erroneous backup withholding.FILE THIS FORM WITH THE PAYER. FURNISH YOUR TAXPAYER IDENTIFICATION NUMBER, WRITE “EXEMPT” ON THE FACE OF THE FORM, AND RETURN IT TO THE PAYER.

Penalties

| (1) | Penalty for Failure to Furnish Taxpayer Identification Number — If you fail to furnish your taxpayer identification number to the Payer, you are subject toa penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect. |

| (2) | Civil Penalty for False Statements With Respect to Withholding — If you make a false statement with no reasonable basis which results in a decrease in theamount of backup withholding, you are subject to a penalty of $500. |

| (3) | Criminal Penalty for Falsifying Information — If you falsify certifications or affirmations, you are subject to criminal penalties including fines and/orimprisonment. |

FOR ADDITIONAL INFORMATION CONTACT YOUR TAX CONSULTANT OR THE INTERNAL REVENUE SERVICE.

- Introduction

- Getting Started

- The Gig Economy: Key Facts

- Sites for Finding Gig Jobs

- Apps for Starting a Side Hustle

- Create an Online Portfolio

- Small Business Websites

- Taking Your Hustle Full-Time

- Gig Ideas

- Lucrative Side Hustles

- Highest-Paying Gigs of 2018

- White-Collar Side Hustles

- Freelance Writing

- Work-From-Home Hustles

- Side Hustles for Retirees

- Taxes for Freelancers

- Sharing Economy 101

- Deducting a Home Office

- Self-Employment Taxes

- Tax Reform and the Gig Economy

- Filling Out Form W-9

- Estimated Tax Payments

- Getting Paid

- Negotiating Your Rates

- How Contractors Get Paid

- Freelancing Contracts

- When You Don't Get Paid

- Should You Work for Free?

Tax Filing for Independent Contractors

Completing IRS Form W-9 isn't something you generally have to deal with unless you're an independent contractor, a consultant, or another self-employed worker.

When you're contracted to provide services to another company and it's expected that you'll be compensated more than $600 a year, the company will ask you to provide a W-9 form. It then uses the form to prepare Form 1099-MISC, reporting the amount of income that's paid to you or your company to the Internal Revenue Service.

Other Circumstances That Might Require Form W-9

You might also be asked by your bank or another financial institution to complete Form W-9 so that they can prepare various types of 1099 forms to report to the IRS any interest, dividends, and other types of income you've earned. You might be asked for one when you're opening an account.

Some real estate transactions require W-9 forms as well, and you might be asked to complete one if a lender cancels a debt that you owe.

Where Do You Get Form W-9?

In most cases, the business or financial institution will give you a blank Form W-9 and ask you to complete it.

If you or your company is in the position of having to issue Form W-9s to independent contractors, you can download the form from the IRS website.

Filling out Form W-9

Completing Form W-9 is pretty straightforward. Just provide your name on line 1, and your Social Security number in Part I. Your name should match the one that appears on your tax return.

Enter your address on lines 5 and 6. Use the address on your tax return if your business address is different from your home address.

Businesses should indicate their name on line 2 if it's different from your name, and their employer identification numbers in Part I. You're certifying to the IRS that the tax ID number you're providing is correct and accurate when you submit Form W-9.

Warning Signs and Red Flags

Form W-9 is a standard tax document. By itself, it doesn't pose many problems, but there are a few situations that might wave a red flag.

Substitute W 9 Form Download For Pc

- You don't know the person or business that's asking you to fill out the W-9. You should always exercise caution when giving out sensitive information like your name, address, Social Security number, or employer identification number. Make sure you know who's asking you to fill out the form, why they’re doing so, and how the tax information you supply will be used.

- Be sure to send the W-9 securely. Don’t send your completed W-9 as an unsecured or unencrypted email attachment. Use a secure method of delivery, such as hand delivery, mail, or an encrypted file attachment to an email.

- Ask what types of tax documents the requester intends to provide to you based on the information contained in your W-9. If you're unsure why you're being asked to complete the form, ask what types of tax documents you can expect to receive when the information is used.

- You expected a Form W-4 instead. If you're starting a new job and your employer hands you a W-9 to fill out, ask if you’ll be working as a self-employed independent contractor or as an employee. Employees complete Forms W-4, not Forms W-9, to set their tax withholdings. Self-employed persons don't have taxes withheld from their pay—they're responsible for making payments to the IRS on their own.

If You're a Limited Liability Company

- If your limited liability company (LLC) is its own separate tax entity, such as a partnership, a C corporation, or an S corporation, report the name of the LLC and its federal employer identification number on the Form W-9. Check the appropriate tax classification box at line 3, indicating whether you're a partnership, C corporation, or S corporation. Do not check the limited liability company box. This sounds counterintuitive, but it's what the IRS wants.

- If the LLC is owned by another LLC, you would then check the limited liability company box. You must also indicate the tax classification of the parent LLC.

- If the LLC is owned by a single member, indicate the tax classification of the owner.

- If the LLC is owned by a single member who is a person, the IRS says that you must indicate the name of the owner on the “name” line and the name of the LLC on the “business name line.” The IRS prefers that you report the owner's Social Security number instead of the LLC's federal employer identification number in this case.

Tips If You’re Subject to Mandatory Backup Withholding

You must also certify on Form W-9 whether you're subject to backup withholding.

Backup withholding is a flat rate of 28 percent on payments made to you or your business under certain circumstances. There are two common reasons for backup withholding: Your name and Social Security number don't match IRS records, or you have one or more outstanding tax debts and the IRS has notified you that you're subject to mandatory backup withholding until these taxes are paid in full.

Most taxpayers are exempt from backup withholding, but you must strike out the language that appears at line 2 in Part II—the certification area—if the IRS has notified you that you're subject to it. This section reads as follows:

Printable W-9 Form

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding.

Real estate transactions aren't subject to backup withholding, so you can cross out this section if you're completing a Form W-9 for this purpose.

Most corporations are exempt from backup withholding as well, but corporations might be required to supply a code in the 'exempt payee code' box at line 4. The same applies if you're exempt from reporting under the Foreign Account Tax Compliance Act (FATCA). In this case, you would enter the code in the box marked 'Exemption from FATCA reporting code' in the same place.

Answers to Commonly Asked Questions

How often should I update a Form W-9?

You should submit a new Form W-9 whenever your information changes. Fill out a new form if your name, business name, address, Social Security number, or employer identification number have changed.

I received a W-9 from an unlikely source. What should I do?

Some people have received requests for Forms W-9 from landlords and other people or businesses. Form W-9 is used to officially ask a person or business to provide their name, address, and taxpayer identification number so that the requesting party can properly issue tax documents to the IRS.

In general, any business that pays you interest, dividends, nonemployee compensation, or other types of reportable income will probably request Form W-9, so it seems unlikely that a landlord would ask you to complete one. If you receive a W-9 from an unlikely source who you don't expect will be paying you money for any reason, ask why it's needed. Don't complete it and submit it if you have misgivings, at least not without consulting with a tax professional first.

I received a W-9 from my employer. What should I do?

Irs Substitute W-9 Form

If you are or were being treated as an employee with a regular paycheck and your employer suddenly asks you to fill out a Form W-9, this indicates that your employer now wants to treat you as an independent contractor. This can be a rather sticky situation.

On one hand, there are some legitimate reasons why you might become an independent contractor rather than an employee. On the other hand, employers sometimes run into financial difficulties and can no longer afford to pay their half of payroll taxes. Reclassifying you as an independent contractor provides an out for them. They don't have to pay these taxes if you're considered self-employed.

First ask yourself whether you are an employee or an independent contractor. If you think you're an employee and you can't reach a consensus after talking with your employer, you can ask the IRS to make a determination of your work status.

Substitute W 9 Fillable

Of course, your employer might not appreciate this, but it's better to be safe than sorry. If your employer reclassifies you as an independent contractor, you become responsible for paying his half of payroll taxes as well as your own as a self-employment tax.

Substitute W 9 Requirements

You're generally not an independent contractor if your employer decides when, where, and how you should do your job, when and how you're paid, or if the job provides any sort of employee benefits.